January Sees US Inflation Climb Above Expectations, Adding Pressure to Economic Policies

Last month, inflation in the United States rose more sharply than anticipated, driven by significant increases in egg and energy costs. This surge has heightened the cost of living for American families.

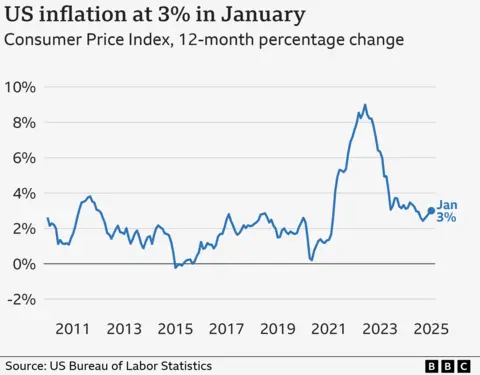

The Consumer Price Index (CPI) edged up to 3% in January, reaching its highest point in six months and surpassing the projected 2.9% forecast by economists.

The latest figures come just weeks after the US central bank opted to retain current interest rates, citing considerable uncertainty about the economic outlook.

Getty Images

Getty ImagesThe increase poses a significant challenge for US President Donald Trump, who prioritized combatting inflation during his election campaign. However, his administration’s policies, including elevated tariffs on imports, have been criticized by economists for potentially exacerbating price rises.

Ryan Sweet, chief US economist at Oxford Economics, suggested that the new inflation data might compel Trump to reassess his tariff strategies, which involve imposing higher taxes on imported goods.

"Tariffs can still be used as a bargaining tool to secure concessions from other countries, but the political perception of slightly increasing consumer prices through tariffs wouldn’t bode well for the Trump administration," Sweet commented.

Last month’s price hikes were widespread, impacting sectors such as automobile insurance, air travel, pharmaceuticals, and other essential items.

Grocery costs rose by 0.5% in the month, up from 0.3% in December, primarily due to a more than 15% jump in egg prices caused by avian flu-related shortages.

This represented the most substantial monthly increase in nearly ten years, according to the Labor Department.

While grocery prices surged, clothing costs saw a decline. In contrast, rents and other housing-related expenses climbed by 4.4% over the past year, marking the smallest yearly increase since January 2022.

Core inflation, which excludes volatile food and energy prices and is viewed by analysts as a more accurate indicator of long-term trends, rose by 0.4% for the month — the quickest pace since March.

"This is not a good number," stated Brian Coulton, chief economist at Fitch Ratings. "It illustrates how the Federal Reserve has not completed the job of reducing inflation just as new risks — such as tariff increases and constrained labor supply growth — begin to surface."

The Federal Reserve had aggressively raised interest rates starting in 2022 to cool economic activity and mitigate pressure on prices. It began lowering rates in September to prevent further economic cooling. However, recent sustained inflation rates above the Fed’s 2% target led to steady interest rates in January.

Federal Reserve chairman Jerome Powell addressed Congress this week, indicating that the central bank is not in immediate rush to reduce rates further. He highlighted that the potential impacts of Trump’s tariff initiatives — which could simultaneously dampen economic growth and elevate prices — remain uncertain for the Fed’s policy decisions.

Last Wednesday, Trump urged the Federal Reserve to decrease interest rates in tandem with implementing tariffs. Nevertheless, following the latest inflation report, some analysts have adjusted their outlook, predicting no rate cuts within the year.

In morning trading, major US stock indices opened lower, while interest rates on US government debt increased as investors anticipated that borrowing costs would stay elevated longer.